When you start a business, one thing becomes clear quickly: knowing is not the same as doing. You can read finance books, follow business coaches, and save every budgeting hack on Instagram. However, until you take action, all that knowledge stays unused.

When it comes to managing business finances, there’s no shortcut. You must act on what you know—and not just once, but every day.

I share this from personal experience—not as a financial expert—but as someone who has faced failed ventures, tight months, and hard-earned lessons. In fact, you can read more about one of those seasons in The Bumpy Road to Self-Employment

This post is for hustlers, dreamers, and entrepreneurs who’ve learned that good intentions don’t pay the bills—disciplined action does.

💡 Develop a Simple Financial Plan for Your Business

Let’s start here:

Comprehensive financial planning is the gift of anticipation.

It helps you prepare for challenges before they hit. Additionally, it supports steady growth and prevents panic when money gets tight.

Your financial plan doesn’t have to be complicated—it just needs to answer key questions:

- What’s your monthly income goal?

- What are your fixed and variable expenses?

- How much money will you need to grow your business?

- Where can you cut unnecessary costs?

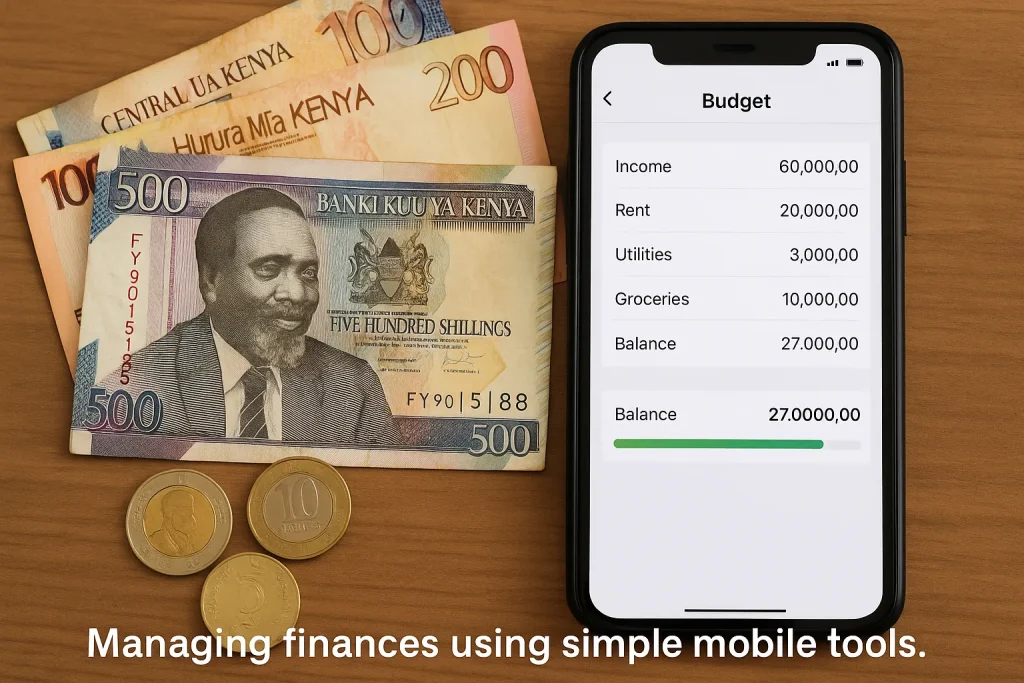

Once you’ve answered those, build a budget—and stick to it. Budgeting isn’t something you do once. Instead, it’s a habit. In time, it teaches you to value every coin and make wiser decisions.

👉 Need help with budgeting? Check out 6 Steps to a Better Business Budget from Investopedia.

📒 Track Every Shilling

This step is non-negotiable.

You must record every sale and every expense. Ideally, get into the habit of writing things down immediately. If not, you risk forgetting or misplacing key information.

You can use:

- A simple notebook

- A spreadsheet

- Or digital tools like:

- Microsoft Excel on Amazon – great for beginners

- QuickBooks Simple Start – ideal for growing businesses

Even if someone pays you in cash, log it. For example, if you spend Ksh 50 on airtime or Ksh 1,000 on transport—record it. These small details form the foundation of solid cash flow management.

🔄 Monitor Cash Flow Daily, Weekly, and Monthly

Here’s a simple routine to follow:

- Daily – Track income and expenses

- Weekly – Review your spending patterns

- Monthly – Adjust your budget and evaluate performance

This habit alone can protect your business from collapse. When you understand your numbers, you make better decisions and avoid surprises.

You don’t need expensive software. However, if you prefer something physical, try a Business Ledger Book—portable and easy to use.

👉 Looking for more insights? Shopify’s article on 7 Ways to Manage Your Cash Flow Better is a great read.

🛑 Avoid Debt – Save First If You Can

From experience, saving and waiting is better than borrowing too soon.

Most lenders won’t care if your child is sick or if sales drop. Repayments will still be due—with interest.

Instead:

- Start small

- Reinvest profits

- Delay expansion

- Build a mini emergency fund (even Ksh 100 a week adds up)

In the long run, this slower route gives you more control and peace of mind.

🤝 Join a Chama or SACCO

This has been a game-changer for me. Joining a chama or SACCO can help you:

- Save consistently

- Borrow at fair rates

- Stay accountable

- Access support during hard times

Sometimes, the structure of a chama brings the financial discipline you’re still developing.

👉 Want to learn more? Visit SASRA – Kenya’s SACCO regulatory body.

🧾 Budget for the Unexpected

Many people only budget for what they know. Unfortunately, that leaves them exposed.

Always include a miscellaneous section in your budget.

Why? Because unexpected costs always show up:

- Transport price changes

- Damaged stock

- Higher electricity bills

- Mobile data top-ups

By preparing for surprises, you protect your profits and reduce stress.

💬 Build a Support System

You don’t have to figure everything out alone.

Instead, surround yourself with:

- A mentor with real experience

- A financial accountability partner

- A bookkeeper (as your business grows)

Running a business is hard—don’t do it in isolation. Find your people. Lean on them.

💥 Tough Truth: Your Business Doesn’t Care About Your Emotions

This might sound harsh, but it’s the truth.

The market doesn’t care that you’re broke. Customers won’t buy just because you’re desperate. Likewise, suppliers won’t lower prices out of sympathy.

This is why your business needs systems, not just emotion.

There were times I knew better but didn’t act. For example:

- I mixed personal and business money.

- I bought on credit when I couldn’t afford to.

- I “borrowed” from the float, thinking I’d return it—but never did.

Still, I learned. And I continue to learn every day.

👉 You can read more of my story in Managing Business Finances.

✅ Summary: Act on What You Know

If you take away just one thing, let it be this:

Discipline is doing what you already know you should do.

You already know you need to:

- Record income and expenses

- Save before you spend

- Avoid unnecessary loans

- Budget ahead

So now, it’s time to do it. Because if you don’t, no one else will.

🛍️ Amazon Tools to Support Your Money Journey

Here are a few resources to help you stay on track:

- 📘 Profit First by Mike Michalowicz – A fresh take on small biz finance

- 📊 Simple Accounting Ledger Book – For daily recordkeeping

- 💻 Budgeting Spreadsheet Template – Excel compatible and easy to use

- 🧾 Receipt Organizer & File Box – Keep your documents in order

📌 Final Thoughts

Managing business finances isn’t a one-time task—it’s a daily practice. It’s not just about knowing the right steps. It’s about choosing discipline, even when it’s uncomfortable.

And the good news? Each time you choose discipline, your business becomes stronger.

So start today.

Stay consistent.

And keep going.

Leave a Reply